nc state sales tax on food

Prepared Meals Tax in North Carolina is a 1 tax that is imposed upon meals that are prepared at. In 1996 the state passed a law to reduce the state sales tax rate on food from the standard rate of 4 down to.

The state sales tax rate in North Carolina is 4750.

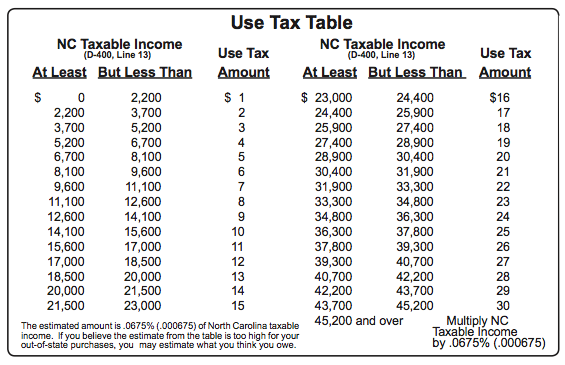

. Find Out More NCDOR Home Form E-502R 2 Food Sales and Use Tax Chart This tax chart is provided for the convenience of the retailer in computing the applicable sales. In 1991 North Carolina increased the state sales tax rate from 3 to 4. Depending on local municipalities the total tax rate can be as high as 75.

Dietary supplements food sold through a vending machine however receipts of items sold through. Is there a food tax in North Carolina. A 200 local rate of sales or use tax applies to retail sales and purchases for storage use or consumption of qualifying food.

The transit and other local rates do not apply to qualifying. Certain items have a 7-percent combined general rate and some items have a miscellaneous rate. With local taxes the total sales tax rate is between 6750 and 7500.

Goods sold by artisan bakeries without eating utensils are considered non-taxable at the state level though they are subject to the 2 local sales tax just like groceries. While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. North Carolina has a 475 statewide sales tax rate but also has 458 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax.

The North Carolina NC state sales tax rate is currently 475. 8 What is the NC sales tax rate. This page describes the taxability of.

The North Carolina state legislature levies a 475 percent general sales tax on most retail sales within the state including prepared foods and beverages in restaurants. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. NC State is not exempt from the prepared food and beverage taxes administered by local counties and.

North Carolinas general state sales tax rate is 475 percent. The State tax but is subject to the applicable State and local sales and use tax. Counties and cities in North Carolina are allowed to charge an additional.

County and local taxes in most areas bring the sales. The exemption only applies to sales tax on food purchases. North Carolina has recent rate changes Fri Jan.

Understanding California S Sales Tax

Food Truck Sales Tax Basics Mobile Cuisine

Online Farm Taxes Explained Property Equipment And Sales 2022 Center For Environmental Farming Systems

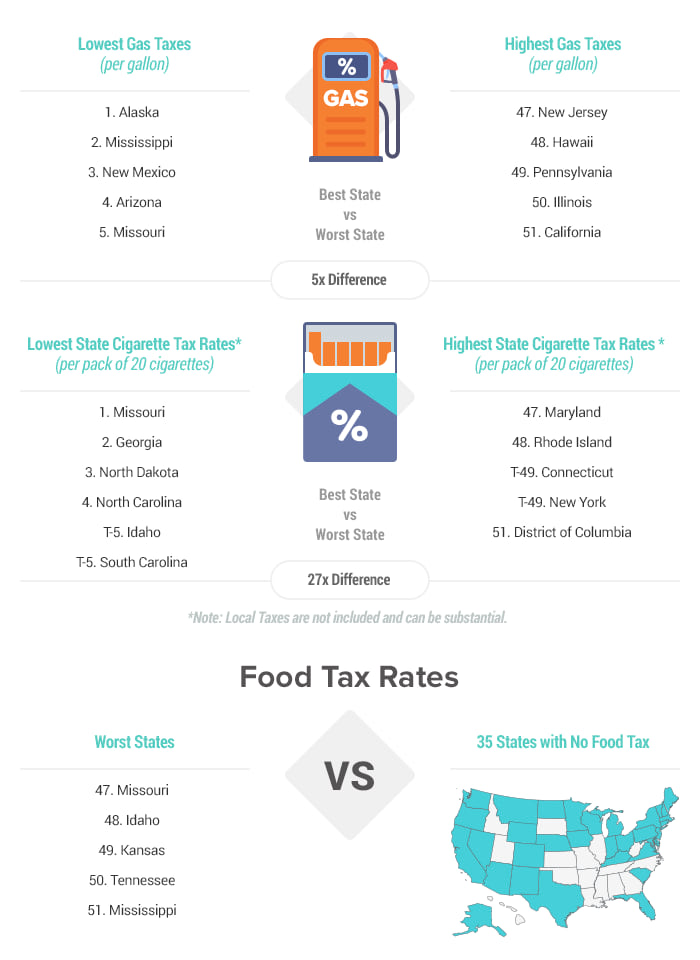

States With The Highest Lowest Tax Rates

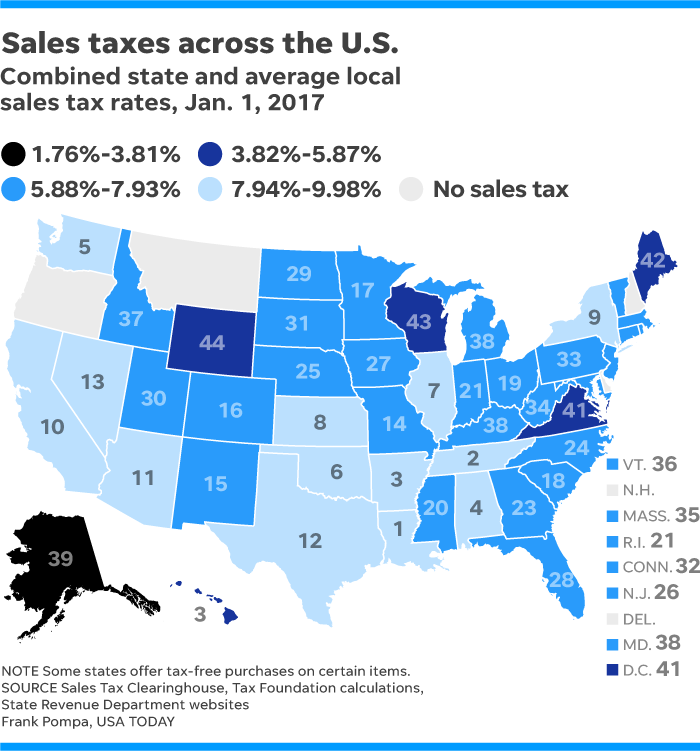

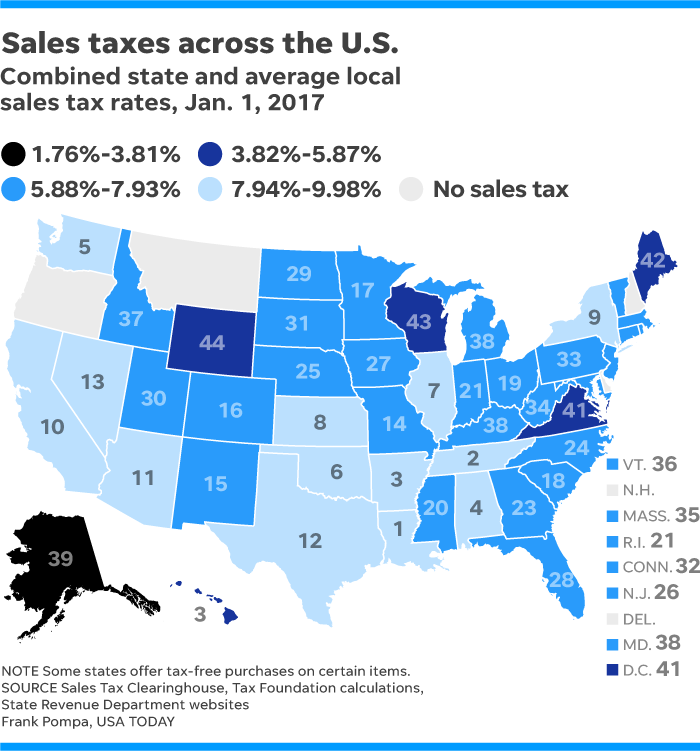

States With The Highest And Lowest Sales Taxes

Both Leading Candidates For Kansas Governor Want To Cut The Sales Tax On Food Kansas Public Radio

How To Get A Sales Tax Certificate Of Exemption In North Carolina

Historical North Carolina Tax Policy Information Ballotpedia

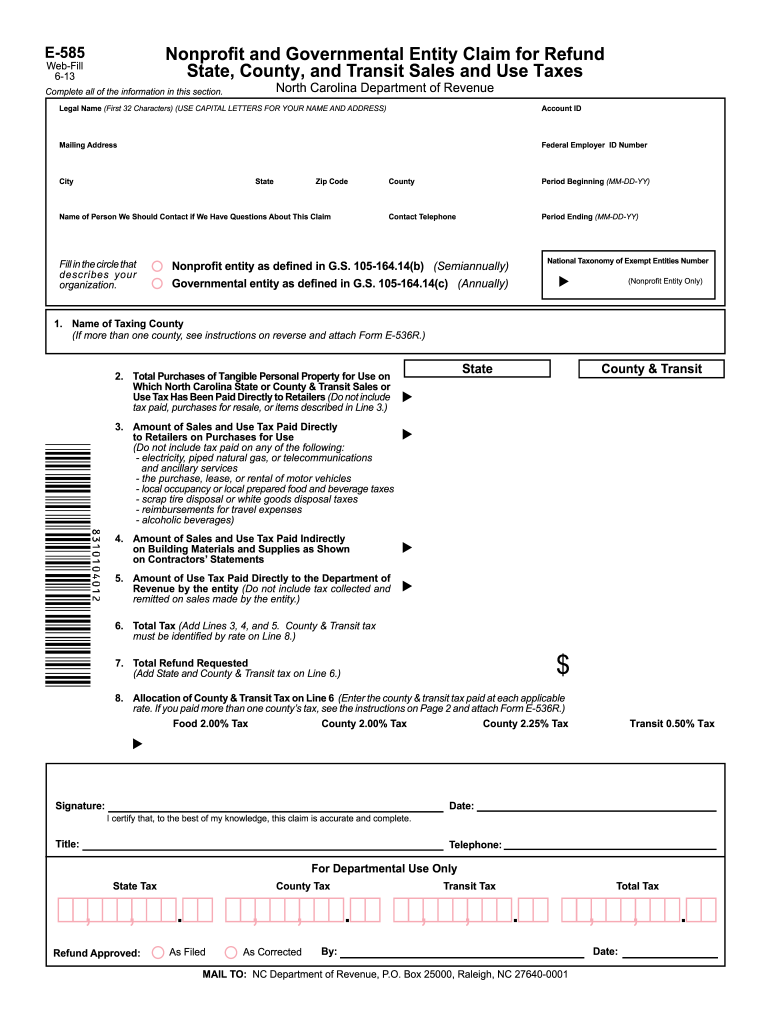

Form Nc Department Of Revenue Fill Out Sign Online Dochub

Sales Tax On Grocery Items Taxjar

Nc Sales Tax Agcare Products Tm

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

North Carolina Sales Tax Rates By City County 2022

Journal Of The House Of Representatives Of The General Assembly Of The State Of North Carolina 1997 1998 Extra Session State Publications Ii North Carolina Digital Collections

Judge Blocks North Carolina Attempt To Get Amazon Sales Data Ars Technica

General Sales Taxes And Gross Receipts Taxes Urban Institute

:max_bytes(150000):strip_icc()/best-and-worst-states-for-sales-taxes-3193296_final_CORRECTED-4d56f8efcd264f53981a40415c0e6de3.png)